Deadlines loom for local governments that received ARPA funding

By Jaclyn R. Davidson, CPA

Pennsylvania’s cities, counties, and municipalities (local government) received $6.15 billion in Coronavirus State and Local Fiscal Recovery Funds (SLFRF), and while COVID is mostly behind us, deadlines connected with the funds loom ahead.

While local governments have until December 31, 2026, to expend all the SLFRF received under the American Rescue Plan Act (ARPA), the funding must be obligated by December 31, 2024.

Additionally, annual reporting requirements to U.S. Department of Treasury (Treasury) continue to April 30, 2027, and, depending on the amount the local government expends each fiscal year, a single audit or an alternative compliance examination engagement (ACEE) may be required in any given fiscal year.

Let’s take a closer look at the SLFRF requirements:

Spending SLFRF

Treasury provided a listing of multiple eligible use categories. Many local governments elected the revenue loss category (also referred to as standard allowance - revenue replacement category). This is the least restrictive category. Under this category the following are restrictions on how a local government’s SLFRF funds can be expended:

- No deposits into pension funds

- No debt service

- No financial reserves / ”rainy day” fund

- No satisfaction of settlements and judgements

- No activities that undermine efforts to stop the spread of COVID-19

Each local government must review the specifications and restrictions on the category elected.

Reporting expenditures and the $750,000 question

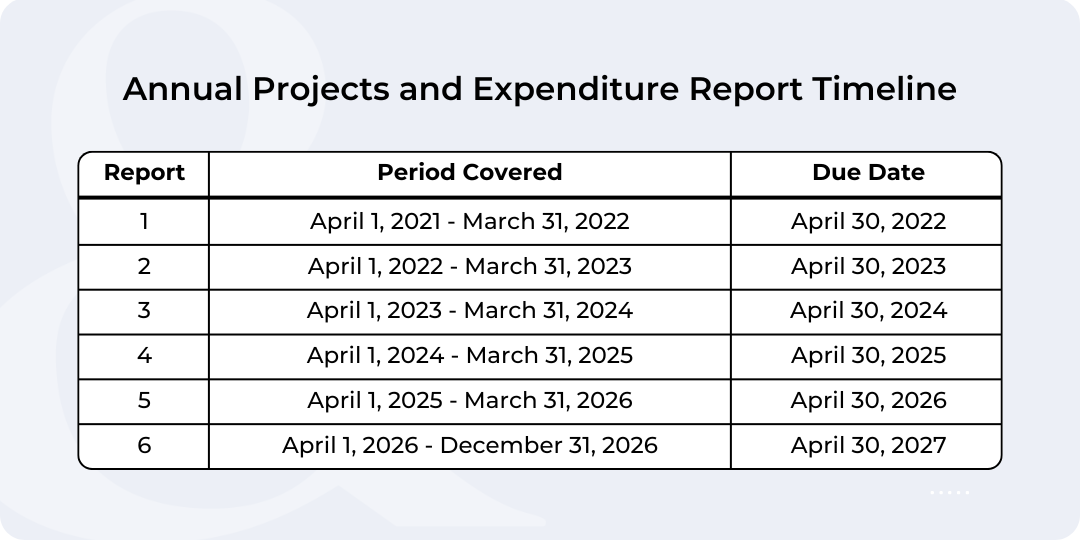

As with any grant, local governments must record how they expend SLFRF, such as salaries, supplies, capital projects, or other allowable expenses. Annually (by April 30), the local government is required to file the annual Project and Expenditure Report for the preceding period of April 1 through March 31.

The next step, each fiscal year, is to determine the total SLFRF expended within the local government’s fiscal year, and determine whether there is an additional requirement for a single audit engagement or an alternative compliance examination engagement.

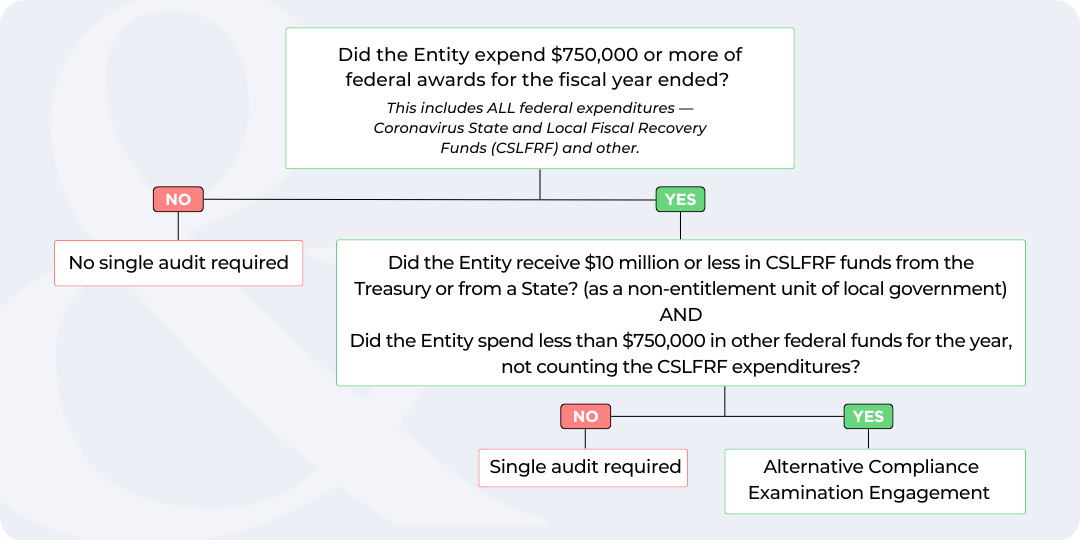

Typically, if an entity expends $750,000 or more of federal funds, within the recipient’s fiscal year, a single audit engagement is required. However, with the offering of the alternative approach, some recipients may not need a single audit.

In comparison to a single audit engagement, an alternative compliance examination engagement is a more simplified engagement. It essentially checks to ensure the local government complied with SLFRF guidelines.

The recipient is eligible to use the alternative compliance examination engagement (instead of a single audit engagement) if:

- The recipient received $10 million or less in SLFRF, and

- For the reported fiscal year, the local government spent less than $750,000 in other federal funds (non-SLFRF).

For example, suppose a township received $2 million in SLFRF. The township expended $1 million in federal funds in fiscal year 2023, of which SLFRF accounted for $800,000 and other federal funds accounted for $200,000. Since the federal funds expended are over $750,000 but the other federal funds were under $750,000 the township is eligible to complete an alternative compliance examination engagement.

The below flow chart provides a quick guide to assist in determining if an engagement is needed:

Deadlines

At this point, Treasury requires local governments to continue reporting on SLFRF through December 31, 2026 with a April 30, 2027 reporting due date.

In addition to having to file the projects and expenditures reports at the end of April each year, as shown in the above chart, if the local government is required to have a single audit engagement, or an alternative compliance examination engagement completed it is due to the federal government by the earlier of 30 days after receipt of the auditor/practitioner’s report, or 9 months after your local government’s fiscal year end.

Bottom line

While the guidelines on how to expend SLFRF funds are broad, ensuring compliance with the regulations can sometimes be confusing.

Boyer & Ritter works with local governments across the state. We’re ready to answer any questions regarding Coronavirus State and Local Fiscal Recovery Funds and assist with the required reporting.